‘Buy the invasion’: Grayscale maps Bitcoin bull case for Russia vs. Ukraine

Grayscale, the world’s largest crypto manager handling more than $37 billion in digital assets, has laid out the bull case for Russia’s invasion of Ukraine.

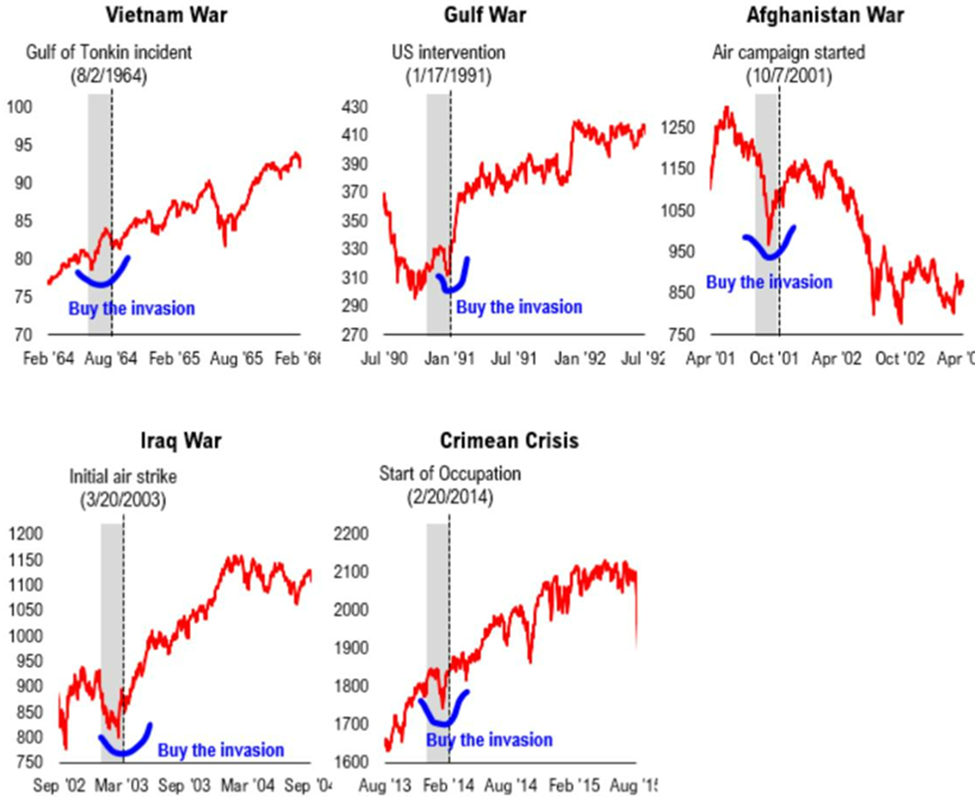

In its latest handout to potential investors, Grayscale harks back to market moves around past invasions — like the ones that occurred in Vietnam, Gulf, and Afghanistan — for insight into Bitcoin’s future performance.

Grayscale generally considers Bitcoin a reflection of the wider crypto economy.

“The US and Russia are not going into a cold war. The swift action gives markets more certainty than a gradual escalation that grinds markets lower,” wrote the Barry Silbert-owned firm.

“History suggests that odds favor a stock rally after an invasion. Crypto assets and stocks have had a high correlation that may continue and boost crypto prices.”

Bitcoin bounces back after Ukraine invasion

Bitcoin’s price fell alongside equities last week as Russian President Vladimir Putin invaded Ukraine.

However, both markets have since bounced back. In Bitcoin’s case, the top cryptocurrency fell more than 15% from its mid-February price of $44,600 to $37,000 last week.

Bitcoin is now worth nearly $41,000 at press time, up 10% since then.

Russia’s own currency, the Ruble, is down 40% to record lows amid tough economic sanctions from the US and European Union.

Across five graphs, Grayscale plotted stock market dips during conflicts across the globe and highlighted corresponding troughs as opportunities to “buy the invasion.”

“During historical invasion events, risk assets (stocks) bottomed just before ‘invasion’ five out of five times,” wrote Grayscale.

“The chart below (data courtesy of Fundstrat) shows equity markets six months prior (two months prior are shaded in gray) and 18 months after invasion events.”

Read more: [Weaponry and cyberwar: How Bitcoin funds anti-Russia efforts in Ukraine]

So far, several Ukrainian cities have turned into battle zones. After five days of conflict, Putin’s shelling campaign and siege tactics threaten local lives.

However, the country’s civilian army is reporting success at holding back Russian troops.

Both the capital Kyiv and second-largest city Kharkiv remain in Ukrainian control.

Others co-sign Grayscale’s ‘buy the invasion’ line

Grayscale isn’t alone in highlighting potential profits found in the uncertainty of conflict. Fundstrat’s chief financial advisor (and notorious bull) Tom Lee has also touted the “buy the invasion” line.

“We [Fundstrat] think any panic around Russia-Ukraine will be short-lived. And hence, we would not be sellers on this panic,” wrote Lee in a note to clients last week (via Business Insider).

Still, Grayscale is no doubt keen to highlight any prospect of its crypto exposure.

On encouragement from Grayscale, around 170 GBTC investors sent letters to securities regulators earlier this month, canvassing a green light for the trust’s conversation to a “spot” exchange-traded fund (ETF).

- As Bloomberg notes, GBTC has fallen over 15% so far this year, a touch more than Bitcoin.

- GBTC still trades at an enormous discount on its underlying assets — more than 25% — detailing lacklustre performance which has sent prospective investors elsewhere.

- Last year, parent Digital Currency Group swooped in with a plan to buy up as much as $1 billion worth of GBTC. This was meant to inspire buying interest.

Converting GBTC from a closed-ended fund to a legitimate Bitcoin ETF is widely considered Grayscale’s only real shot at bringing interest back — especially now that North American markets are practically littered with alternatives.

“Long-term investment story for crypto is still intact,” said Grayscale.

“Regardless of short-term market narratives, Bitcoin has proven its ability to maintain and grow purchasing power over the long term and crypto has been a strong investment in tech disruption.”

Still, something tells us retail investors “buying the invasion” just won’t cut it for Grayscale’s flagship Bitcoin fund.

Looking for bite-sized news? We’re on Twitter.