Super wealthy investors in Asia keen on crypto, study shows

A new study suggests that in Q2 2022, most family offices (FOs) and wealthy investors in Singapore and Hong Kong were investing in digital assets.

KPMG China and Aspen Digital released a report on Monday that surveyed and interviewed 30 FOs and high net worth individuals (HNWIs) in the second quarter of the year — at the end of which, TerraUSD collapsed and triggered a bear market.

Around 61% of FOs and HNWIs interviewed had assets under management between $10 to 500 million, while 12% managed more. 92% of participants said they were interested in digital asset investment. 58% of those surveyed were investing already — of those, 100% invested in Bitcoin and 87% in Ethereum — and 34% planned to do so.

Read more: China is watching transactions as its CBDC roll-out gains traction

However, subsequent market volatility could impact those figures if surveyed today. The paper acknowledges the bear market as a reason why FOs and HNWIs may have since reevaluated the risks and rewards of digital asset investment.

“Clients and private management (PWM) institutions will need to carefully assess the current market conditions with regards to digital asset portfolio management,” the study admits.

Hurdles to digital asset investment grow higher

36% of participants said mainstream institutional attention to digital assets was a key reason to invest. 64% cited high upside potential as another — 14% said hedge against inflation and 7% answered currency debasement as key reasons.

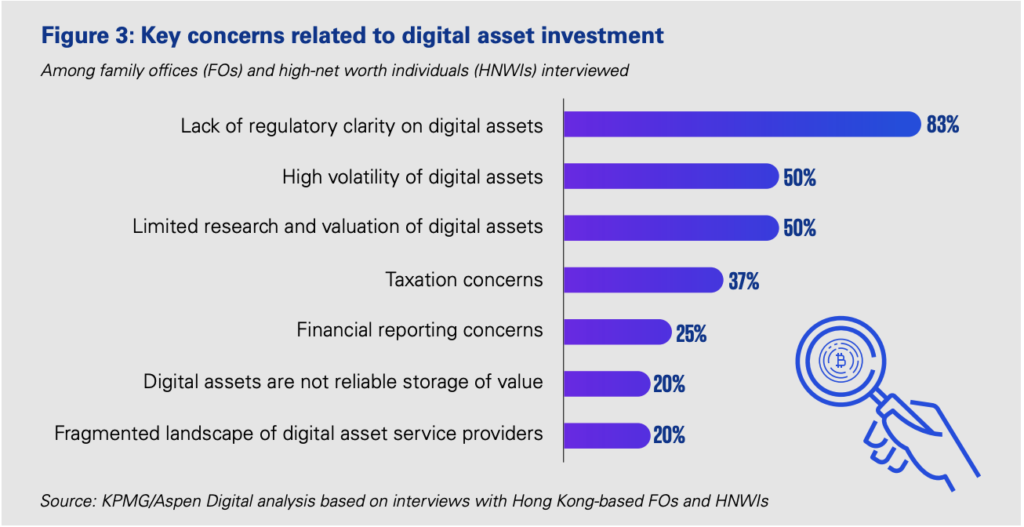

However, the top three hurdles to digital asset investment were lack of regulatory clarity (83% agreed), high volatility (50%), and limited research and valuation (50%). Other concerns included tax and financial reporting (37% and 25%, respectively) and the fragmented landscape of digital asset service providers (20%).

Paul McSheaffrey, partner at KPMG China, stated that clear regulations would “comfort” investors. “Many jurisdictions are starting to license exchanges and brokers that deal in digital assets, providing more regulatory certainty and therefore comfort to institutional investors,” he said.

Read more: Explained: The battle for crypto regulation in the US

The portfolio allocation of FOs and HNWIs reflect the weight of these collective concerns, which have presumably intensified since May — 60% of respondents that already invested in digital assets allocated less than 5% of their portfolio. However, 20% said they invested 10 to 20% of their portfolio.

Most FOs and HNWIs said that regulator attitudes towards digital assets was important in making investment decisions. In an interview, one Hong Kong-based FO said that the government should provide more clarity in digital asset regulation to protect investors. The city’s government announced an anti-money laundering and counter-terror financing bill this summer which will provide stricter reporting requirements for businesses and virtual asset service providers (VASPs).

Singapore’s recent crackdown on similar risks has seen the exodus of several crypto companies. It began to restrict crypto ads in public areas in January, which also resulted in the removal of crypto ATMs.

Once known for welcoming the crypto industry with open arms, the Monetary Authority of Singapore (MAS) heightened enforcement in July. It threatened to limit the ability of non-accredited investors to access certain crypto services, especially leveraged (margin) trading. Binance, FTX, Huobi, and many smaller companies decided to set up shop elsewhere.

Investor interest in DeFi despite recent hacks

In Q2, respondents showed interest in DeFi as a growing area of opportunity. Since then, attacks on protocols have intensified — in October alone, three major hacks occurring in just one day resulted in the loss of $115 million.

However, attacks on DeFi protocols have occurred prior to Q2. Notably, Binance Smart Chain hackers made $167 million with flash loans and exploits in May 2021. Three months later, Polynetwork was hit by a ‘white hat hacker’ to the tune of $600 million.

Despite this and respondents’ affinity for regulation and security, 60% of respondents already invested in DeFi tokens. In fact, DeFi was ranked second by participants as a key area of interest within digital assets. Metaverse and NFTs ranked third and smart contract platforms fourth.

For more informed news, follow us on Twitter and Google News or listen to our investigative podcast Innovated: Blockchain City.