Senators and investors want CFTC to regulate crypto instead of SEC

SEC chairman Gary Gensler is facing heightened pushback from the crypto industry; a new bipartisan Senate bill would see the Commodity Futures Trading Commission (CFTC) take the lead in Bitcoin and Ethereum regulation. The move comes amid a change.org petition to oust Gensler as chairman, which has almost 24,000 signatures at press time.

Under a bill proposed by senators Debbie Stabenow (D-Mich.) and John Boozman (R-Ark.), the SEC would no longer be the leading agency to govern bitcoin and ether trading and would provide stronger clarity about the classification of these digital assets. Gensler has been vocal about his stance on bitcoin, deemed a security by him, but has so far failed to categorize ether.

Confusion over crypto regulation has incensed companies and retail traders alike. Following the collapse of Terra (LUNA) and its stablecoin TerraUST, regulators have been scrambling to put together legal frameworks that would protect investors and the financial system.

Handing regulation of the two most prominent cryptocurrencies to the CFTC, about six times smaller than the SEC, appears to be a welcome move for some in crypto. In a Wednesday call, Boozman said the crypto industry “almost universally” prefers CFTC regulation. The senator believes this will make it easier for the bill to pass.

CFTC chairman Rostin Benham is equally in favor. Last month, he gave a speech in which he said sharing regulation responsibility in a “patchwork blanket” approach is “increasingly proving inadequate.”

Former CFTC chief Gensler can’t appease crypto investors

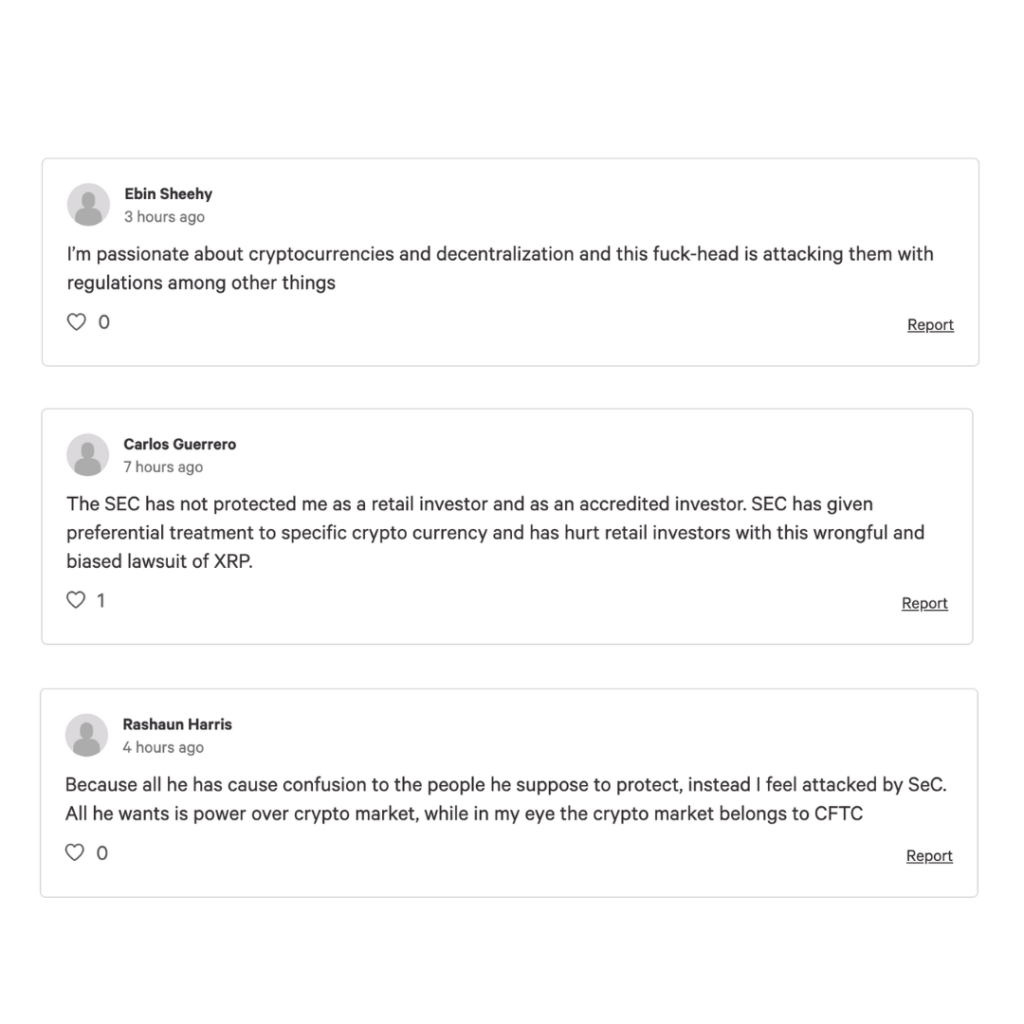

Retail investors appear to be interested in a move to CFTC crypto regulation, which many believe would take a less aggressive approach than the SEC.

An ongoing court case against Ripple (XRP) has seen crypto enthusiasts take up the mantle in a flame war against the agency and Gensler.

A petition to remove the former head of the CFTC from his current position at the SEC has amassed over 23,500 signatures. The change.org petition accuses Gensler of “obstruction of justice due to his lack of enforcement of the laws pertaining to naked short selling and lack of competent oversight of market maker activities.”

“Due to Mr. Gensler’s crimes, million of retail investors were defrauded of countless MILLIONS of dollars,” (their emphasis). It calls for Gensler to step down as chairman and for a “thorough, detailed, forensic […] investigation into Citadel Securities and Citadel Market Maker.”

Citadel Securities and Robinhood were accused of market making during the GameStop shortening. However, most signatories appear to be participating due to their unwillingness to have crypto markets regulated in general.

Read more: Grayscale lawsuit against SEC escalates the GBTC hostage crisis

The chairman has recently come under fire from major publications regarding his crypto stance. In an analysis by the editors at Bloomberg that was posted in the Wall Street Journal, it criticised Gensler and the SEC’s interest in eliminating payment for order flow. Such a move would disrupt market makers like Robinhood and Citadel, as well as retail traders who would miss out on price advantages over hedge funds.

It’s unclear whether Citadel is responsible for the petition’s momentum, or whether anything can actually come of it. The government is under no responsibility to take the petition or its signatories seriously, regardless of how many people sign.

The government’s own petition platform, We the People, says it will take petitions into account if 100,000 people were to sign. However, it was shut down by Trump’s administration and discontinued under president Biden.

For more informed news, follow us on Twitter and Google News or listen to our investigative podcast Innovated: Blockchain City.