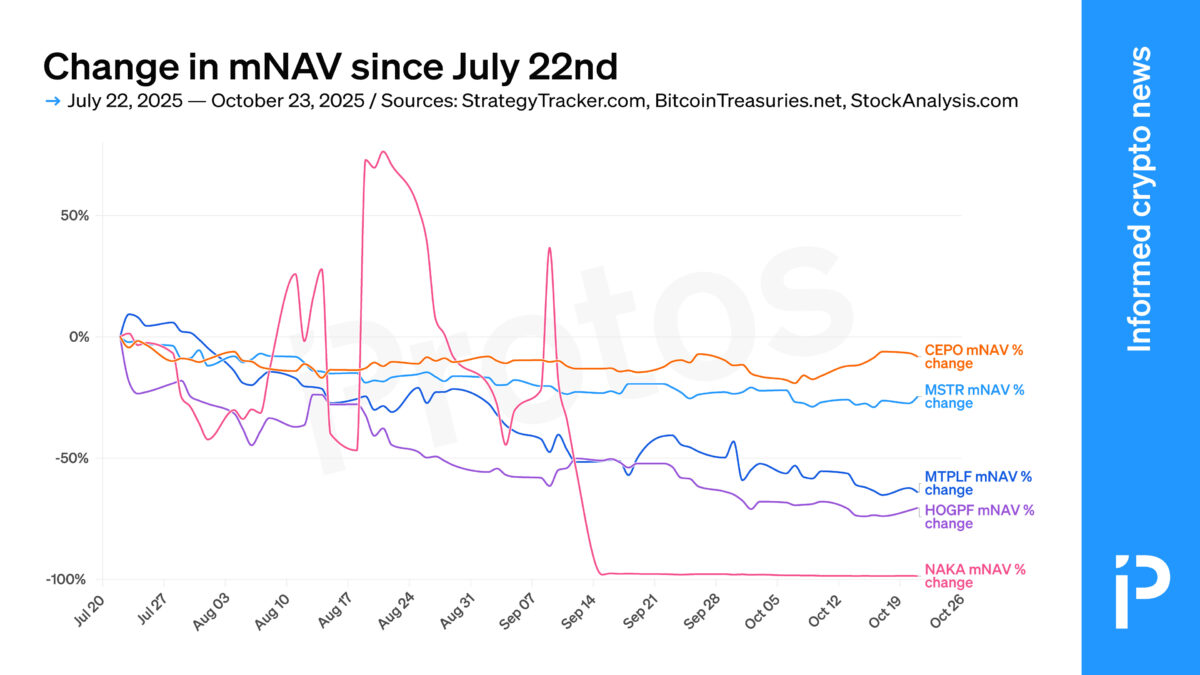

CHART: mNAV down across bitcoin treasury companies

Protos repeatedly warned that the peak for bitcoin (BTC) treasury companies had passed by late May, and those warnings have proven accurate.

Indeed, the industry continues to fall further out of favor with investors, as demonstrated by the relentless downtrend in these companies’ most important metric — their multiple-to-Net Asset Value (mNAV).

Investors’ convey their confidence in management’s ongoing ability to accrete BTC per share on a ongoing basis via the mNAV they pay when buying common stock.

Unlike traditional companies that focus on selling products and services to customers, BTC treasury executives like Strategy (formerly MicroStrategy) founder Michael Saylor believe that amassing BTC allows them to accrete additional BTC by leveraging and financializing that treasury.

Although tracking the mNAV for all treasury companies is complicated by lengthy merger documents, equity swaps, and thousands of pages of Securities and Exchange Commission filings, Protos has compiled the mNAVs for five large BTC treasury companies since July 22 in the chart below.

Together, they chart a clear downtrend.

For a few years prior to 2025, investors paid an mNAV above 1x on the few BTC treasury companies that existed. For example, from 2021 through 2024, Strategy enjoyed an mNAV above 2x for several months and, on average, an mNAV well above 1x.

In other words, investors paid more for the company than its BTC holdings, despite minimal earnings or other business operations. They bid up his stock because they believed Saylor could financialize his treasury by selling credit products at advantageous prices and scale.

Abroad, the smaller Metaplanet, a kind of Japanese Strategy, enjoyed an even higher mNAV multiplier in 2024 in the high-single and even double digits.

By early 2025, a fleet of public companies decided to transform into BTC treasuries.

The early 2025 bitcoin treasury company bubble

Riding the momentum of Strategy, Metaplanet, and Tether’s highly successful Twenty One (initially trading as CEP, soon as XXI), mania peaked in May with David Bailey’s Nakamoto (initially KDLY, now NAKA).

At one point, investors paid a historic high mNAV of 23x for Nakamoto that, for context, has now declined to less than 1x.

Undeterred, companies continued to pursue mergers, special purpose acquisition companies, or more complicated business combinations for many additional months, earning a lower and lower premium for each successively underwhelming launch.

Today, there are over 200 public companies holding a combined 1 million BTC on their balance sheets. Some companies trade for less than 1x their BTC treasury.

Nevertheless, the ratio between the BTC they hold and their common share prices has continued to deteriorate since May.

Read more: Strategy’s mNAV falls to 19-month low as BTC outperforms

Many mNAV trackers such as BitcoinTreasuries and StrategyTracker provide a historical reference for the mNAV premiums of these companies. With very few exceptions, their premiums peak in May or during the initial days of their launch, then slowly decline over time.

The five companies charted above are in many ways representative of the sector, which continues to disappoint investors for the second half of 2025.

Whether there will be a resurgence of interest in BTC treasury companies remains to be seen.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.