Animoca Brands has a web3 portfolio worth $1.5B because it said so

Animoca Brands, the delisted Australian blockchain gaming juggernaut and prolific crypto VC, announced Monday that its web3 investment portfolio was internally valued at $1.5 billion dollars across 340 companies at the end of April, according to an unaudited “investor update.”

The report also highlighted several other key numbers: digital asset holdings of $211 million (USDC, USDT, BUSD, ETH, and BTC), “other digital assets” and third party tokens valued at $659 million and, most curiously, digital asset reserves “not reflected on the Company’s balance sheet” of $4.2 billion.

Amusingly, this last category reflects the self-reported, unaudited value of Animoca Brands tokens used for its, often troubled, blockchain gaming ecosystem, including the Sandbox (SAND), REVV token, PRIMATE token, and a slew of other proprietary tokens issued through its numerous portfolio companies.

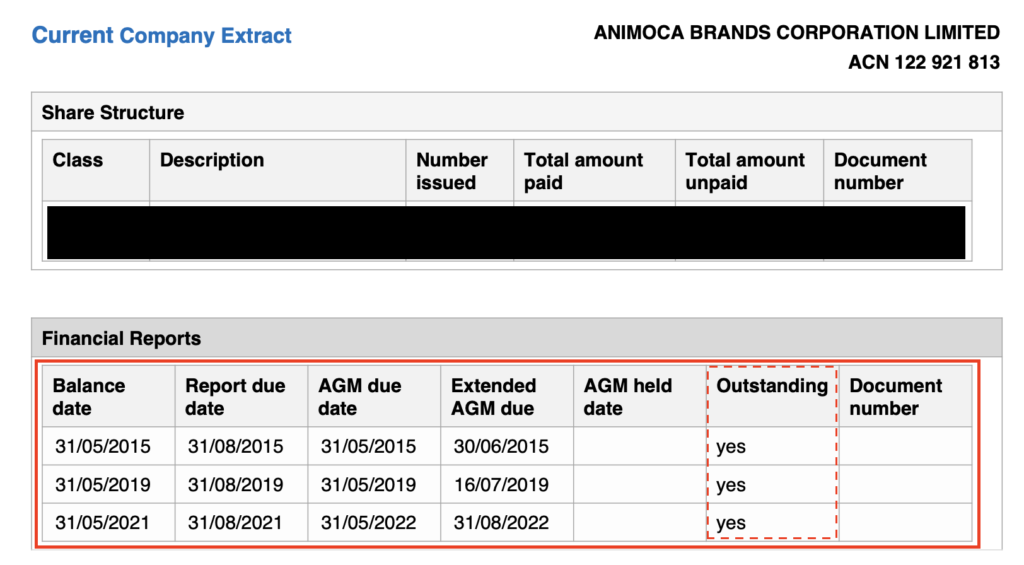

This update was shared despite having failed to produce several outstanding Annual General Meeting reports and their requisite financial audits and documentation dating back to 2015, according to the Australian Securities Investing Commission (ASIC).

The company addressed this ongoing non-compliance in its latest ‘investor update’: “The Company continues to work towards completion of its outstanding financial reporting requirements.”

Animoca Brands are brands you already know

Animoca Brands is one of the largest players in the NFT gaming space, capitalizing on partnerships and crypto investments with some of the most widely known brands in the industry, including BAYC and Otherside by Yuga Labs, and Cryptokitties and NBA Top Shots creators Dapper Labs.

However, the conglomerate currently exists in an uncommon legal limbo in Australia; it was delisted from the Australian stock exchange (ASX) for governance, personnel, and non-compliance issues in 2020.

Animoca has lightly pivoted from mobile games to web3-powered gaming. However, branding and intellectual property (IP) licensing remains one of the firm’s core strategies — giving it access to a steady supply of goodwill and marketing reach. Of note, the firm has released products with IPs from Disney, Square-Enix, WWE, Snoop Dogg, the Walking Dead, Planet Hollywood, and MotoGP.

Before leading the charge into the NFT gaming space, it was a traditional mobile games developer, releasing projects tied to global IPs like Garfield, Ben 10, and Doraemon. However, Apple delisted it from its App Store in 2012 for violations relating to cross-promotion of their own games, according to Animoca Brands chief exec Yat Siu.

Read more: Paolo Ardoino clashes with hedge funder over shady Tether disclosure

The current company went public in 2014, through a reverse merger with a mineral exploration and mining company known as Black Fire Minerals. The failed gold and copper venture, working in Australia and Namibia, divested itself of all mining assets prior to the transaction. Not exactly a typical web3 origin story.

As an unlisted but still public corporation, the firm is still obligated to comply with communication requirements and reporting standards applied to “disclosing entities” in Australia, due to the continuing public ownership of shares. This has proved challenging for Animoca, and they have not pursued listing on any other exchange despite claiming to prioritize this move.

Animoca Brands’ operations are located entirely in Cyberport, Hong Kong, placing them beyond the reach of much of ASIC’s enforcement.

Animoca’s statements suggest their business is staying hot despite the chill taking hold of NFT markets — yet it remains to be seen if they will be able to substantiate their lofty self-valuations with third party audits and regulatory approved reporting. Attestations and updates only do so much in the way of proof, being much better for deflecting criticism and maintaining hype.

For more informed news, follow us on Twitter and Google News or listen to our investigative podcast Innovated: Blockchain City.