Brookings Institution disputes claim that crypto improves financial inclusion

Brookings Institution, the influential Washington DC-based think tank, has disputed promises about crypto’s oft-heralded claim of improving financial inclusion. In her report on behalf of Brookings, Tonantzin Carmona disputed digital assets’ potential for improving everyday access to financial services.

Carmona cited reports by the US Treasury that responded to President Biden’s executive order for government agencies to propose regulatory frameworks for digital assets. The Treasury described digital assets as risky for disadvantaged populations in its report, “Crypto-Assets: Implications for Consumers, Investors, and Businesses.” It concluded that digital assets have not lived up to their promised potential to include traditionally excluded populations.

Portions of disadvantaged populations are using digital assets. A survey conducted at the University of Chicago showed that 44% of US digital asset traders are African-American and Latino. The Federal Reserve also admits that an increasing number of underbanked individuals use digital assets.

However, Brookings notes that the groups that could benefit from greater financial inclusion don’t overlap as much with digital assets as crypto promoters seem to think.

Brookings identifies crypto’s problem of competing narratives

According to Brookings Institution’s report, digital asset marketers use two narratives that could complement one another on the surface level, yet compete at deeper levels.

The first narrative posits that digital assets can provide an alternative method for transacting. People who don’t find it easy to visit banks or use digital banking apps could, for instance, download a bitcoin wallet instead. Unlike banks, digital assets can process transactions 24 hours a day.

The second narrative suggests digital assets as a way to build wealth. Supporters of this narrative will typically use the slang term “HODL” and suggest that their favorite crypto will retain or increase value. A few in this camp support DeFi apps for depositing digital assets to earn interest. This narrative discourages using digital assets for everyday transactions, emphasizing their investment attributes instead.

Naturally, people interested in greater financial inclusion might ask which option potential digital asset users would prefer, if supporters could offer methods as convenient as swiping a debit card. Can users use digital assets for transactions or building wealth? How can the crypto community solve problems if it cannot even agree on one goal?

In the first place, buying crypto almost always requires a bank account. While some exchanges may allow customers to purchase digital assets with a prepaid debit card, many top exchanges, like Coinbase, require clients to connect a bank account.

Many underbanked or unbanked people cite factors like their inability to maintain a minimum balance, high bank fees, or mistrust of banks. These people can already find alternatives like prepaid debit cards that are convenient and easy to use for everyday transactions ⏤ with no need for a bank account.

Digital assets’ blockchains typically cannot handle high transaction throughput. Any blockchain with transactions per second on par with Visa or Mastercard usually sacrifices decentralization almost entirely, opting for an oligopoly that agrees to pay for large data center infrastructure.

Developers are trying different scaling solutions, but none of them can scale a decentralized blockchain like Bitcoin up to Visa’s level. This limitation can slow down or even stop digital assets from replacing banks and credit cards.

Crypto as a wealth-building tool is hardly promising

Secondly, digital assets are not a wealth-building tool for billions of people who have no money to invest in the first place. Wild price swings make digital assets an uncertain way to build wealth. Many people are indebted or have no investable funds.

Brookings also mentions other historical ways that digital assets cannot address the obstacles for traditionally disadvantaged populations in the US. Past pushes to give families an economic advantage included the 1862 Homestead Act, which promised acres of land to people willing to resettle, and the 1944 G.I. Bill, which promised free college and assistance with starting a business or buying a home to eligible veterans. However, most benefits went to white men and excluded minorities and indebted populations.

This caused the problem of unequal generational wealth. White families have a median wealth level of $188,200 — overwhelmingly attributable to owning real estate. Hispanic families have a median of $36,100. African-American families have an average wealth level of $24,100.

People who grew up in poorer families have more obstacles for obtaining favorable credit terms for starting a business or accessing higher education. Digital assets would need to address these issues to improve their image as a tool for improved financial inclusion.

Brookings outlines the many hidden fees of crypto

Third, Brookings recommends that digital asset supporters should build far better on- and off-ramps for international currencies. Supporters promoted digital assets as a fast and cheap way to handle international remittances.

They advertised that a sender using digital assets could send thousands of dollars across national borders for mere pennies instead of losing a percentage of the money sent to remittance services like Western Union. The recipient could receive local currency in minutes instead of days.

However, like remittance services, fees and banking rules still apply. Some users in countries whose banking system prohibits connections to crypto exchanges must search for rare and expensive crypto ATMs to convert digital assets to cash.

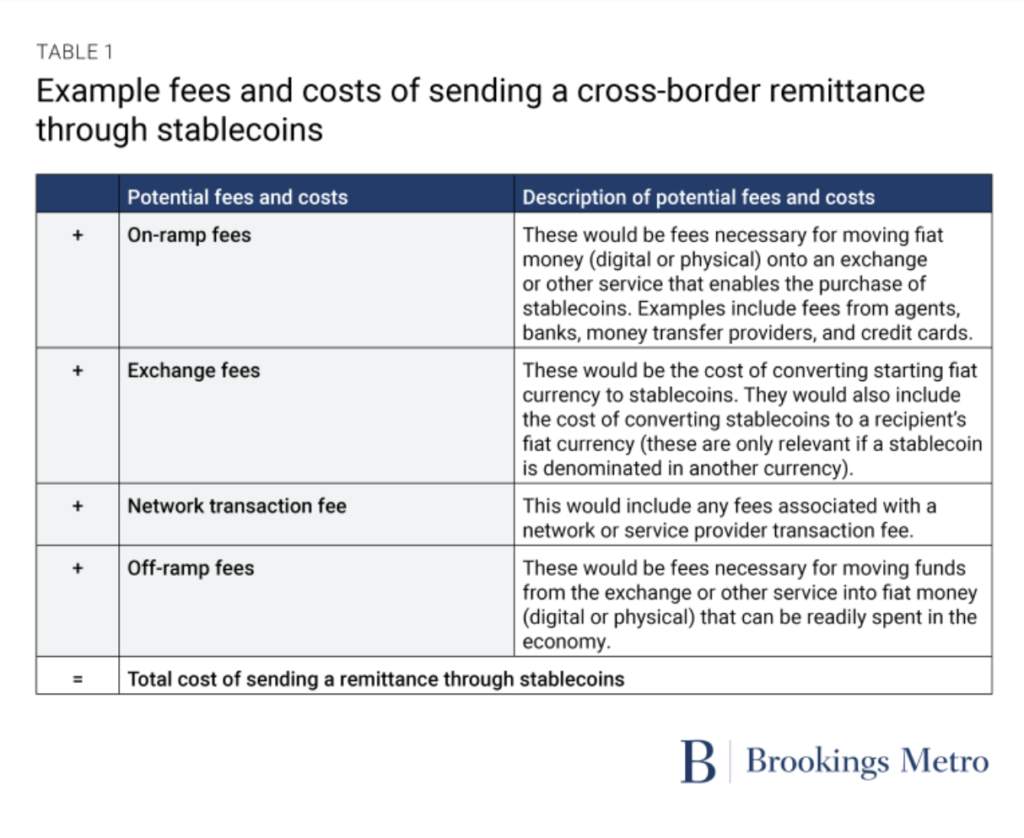

If recipients preferred to keep their crypto balance without converting to fiat, they would have to procure rare vendors for spending a digital asset within their local community. Digital asset international remittances still have to deal with fiat on- and off-ramps, plus exchange and transaction fees.

Read more: NEAR’s TVL down bad after axing Terra-like USN stablecoin

Consumer protection is still lacking

Fourth, lack of consumer protections can be a problem. In June 2022, Fortune Magazine warned that Celsius Network’s customers might not have the usual consumer protections if it went bankrupt.

On July 28, 2022, the Federal Reserve announced that it and the FDIC had co-signed a letter demanding that Voyager Digital stop advertising that it had deposit insurance with the FDIC. The subsequent collapse of Voyager highlighted the lack of consumer protections in the digital asset space.

Brookings warned that future pushes for financial inclusion could lead to the same predatory practices as the subprime mortgages, payday loans, and check cashing services that tend to take the place of shuttered bank branches in disadvantaged neighborhoods. Similarly, crypto ATMs are beginning to pop up at convenience stores in low-income communities, and they can extort fees as high as 20%.

In light of these issues, Brookings has suggested that better ways to improve financial inclusion already exist ⏤ and they don’t require crypto. An obvious tactic might, for instance, remove systemic barriers to opening a bank account through legislation.

The Federal Reserve is also working on an instant payments service called FedNow, which it plans to launch in mid-2023. Carmona also hinted that the Federal Reserve could directly offer central bank accounts for individuals and businesses directly, instead of limiting it to Master Account-approved financial institutions.

In all, Brookings Institution recommends policymakers to look more closely at promoting greater financial inclusion without the use of crypto.

For more informed news, follow us on Twitter and Google News or listen to our investigative podcast Innovated: Blockchain City.