FATF says ‘stablecoin’ is just a marketing gimmick in latest crypto guidance

Global money overseer Financial Action Task Force (FATF) released an updated edition guidance on crypto and Virtual Asset Service Providers (VASPs) last week, and it still leaves something to be desired.

FATFs latest effort details requirements for countries to assess and mitigate risks associated with crypto.

It also attempts to plot regulation of service providers and financial activities tied to digital assets.

The update includes refinements to the FATF’s definition of stablecoins, virtual assets (read: cryptocurrencies), and VASPs.

FATF claims to be concerned about money laundering and terrorist financing that may be enabled by unsurveilled peer-to-peer payment technologies.

Coin Center labels FATF crypto language ‘circumspect’

Crypto lobbying unit Coin Center immediately summarized and responded to FATF’s update.

According to Coin Center, FATF’s new definition of VASP removes all references to persons who merely facilitate or govern transfers of digital assets (like node operators).

Instead, FATF’s guidance now focuses on the control of digital assets, and excludes persons who “merely provide ancillary infrastructure,” including “verifying the accuracy of signatures.”

- FATF finally conceded that full Travel Rule requirements only apply to digital asset transfers between two VASPs — not those between a VASP and an unhosted wallet.

- This means exchanges won’t have to farm identifying information for recipients of withdrawals to individual crypto wallets.

- FATF clarified that merely publishing software that creates new digital assets (like mining software) doesn’t make that creator a VASP (and fees paid to miners/validators aren’t subject to the Travel Rule).

Coin Center did however criticize “vague and inconsistent statements” about multi-signature transactions, and complained that FATF guidance regarding DeFi is “overbroad.”

FATF also gave “puzzling” guidance about persons who launch and maintain automated tools, said the group.

“This is a very long document. It continues to advocate for an ‘expansive’ approach and repeatedly uses vague weasel words like ‘actively facilitates’ and ‘may qualify,” wrote Coin Center.

Coin Center noted that it would be inappropriate for such “non-specific and confusing standards” to govern the crypto ecosystem in the US — especially as penalties for failing to adhere to financial surveillance requirements are severe (felonies, fines, jail time).

“It is, therefore, inappropriate for a law with such unforgiving penalties to be drafted with such circumspect and uncertain terms,” said Coin Center.

FATF maintains a blacklist

FATF was established in 1988 at the Paris G7 Summit. It currently has 38 member nations.

It is a gargantuan financial watchdog with vast surveillance powers. Nearly every large bank in the world attends to FATF guidance.

Over 200 countries also submit to its rules for fear of ending up on its blacklist — a document identifying nations FATF deems lacking in sound enforcement of financial activities like money laundering.

It refers to them as “high-risk and other monitored jurisdictions.” Colloquially, the media just calls it the dreaded FATF blacklist. Currently, Iran and North Korea are the only two nations on this document.

Historically, blacklisted countries have openly pursued crypto as a way to evade economic sanctions. Iran’s central bank, for instance, has approved the use of cryptocurrencies for imports.

Venezuela also tried (and failed) to use PetroMoneda (PETRO) and various crypto mining initiatives to attract international investment.

FATF pushes ‘crypto is used for money laundering’

Money laundering is the process of cleaning the proceeds of criminal activity to disguise their illegal origin. It enables criminals to cash out and use profits in real life without revealing illicit behaviors.

According to the US Sentencing Commission, 755 people were convicted of money laundering in the U.S. in 2020, with a median theft of $301,606.

US judges sentenced most (87%) of those money laundering offenders to an average 5.3 years in prison.

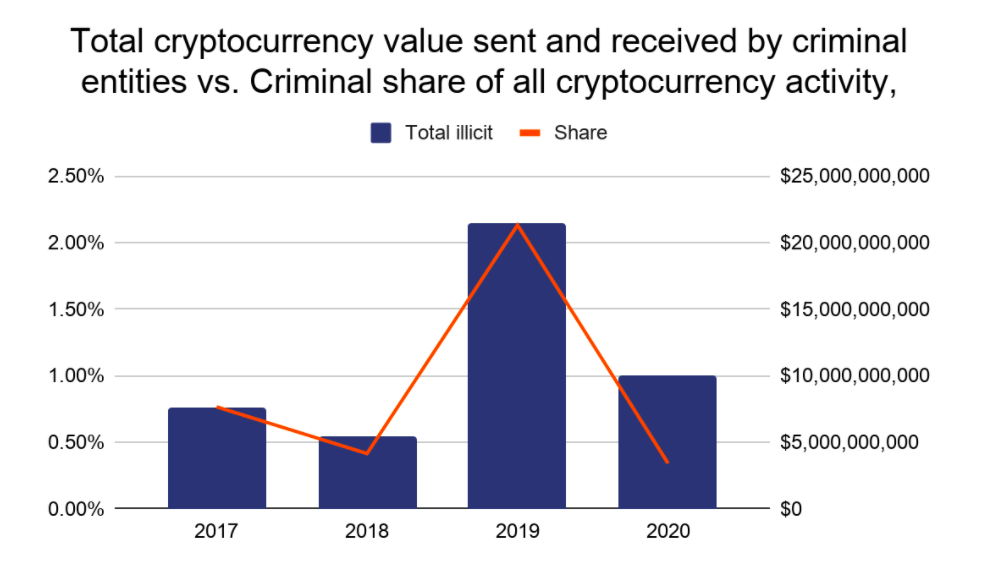

Best estimates show that cryptocurrencies were used in only 0.9% of money laundering by dollar value in 2019, per Chainalysis.

Still, FATF remains intent to prove crypto is a possible facilitator of money laundering.

In 2020, global banks paid $14.4 billion in total fines. Goldman Sachs paid the largest fine of $3.9 billion. Violations of anti-money laundering regulations were the most common reason for bank fines.

In an attempt to acknowledge possible harm by what it calls “misapplication” of its standards, FATF also released a report last week on mitigation of the unintended consequences of its standards.

“FATF remains vigilant and will closely monitor the virtual assets and VASPs sector for any material changes that necessitate further revision or clarification of the FATF Standards,” wrote FATF (our emphasis).

“This includes in relation to areas covered in this Guidance such as stablecoins, peer-to-peer transactions, non-fungible tokens and decentralized finance.”

US hyper-concerned about stablecoins

The US dollar’s position as the world’s reserve currency affords regulators in Washington DC an endless stream of benefits.

Historian Niall Ferguson in 2005 encapsulated this in four words for the New York Times: “Our Currency, Your Problem.”

The overwhelming majority of global trade is denominated in US dollars, and approximately 70 countries peg their currencies to USD.

This status affords the US the least depreciation in the value of the dollar as it prints more dollars.

Because the demand for dollars remains strong (with the least sensitivity to supply than any other currency), US regulators enjoy a one-of-a-kind privilege of being able to print the most amount of their own currency with the fewest consequences.

It therefore remains in the self-interest of nearly every US regulator to maintain the preeminence of USD by delaying or attacking stablecoins.

Regulators generally perceive stablecoins as a national security threat as they purportedly dampen the impact of economic sanctions.

US Treasury effectively runs the FATF

As the most powerful financial regulator of the world’s largest economy, the 100,000-employee US Treasury Department is (candidly) the de-facto leader of FATF.

Treasury has repeatedly expressed concerns about stablecoins that are pegged to a relatively stable asset such as the US dollar.

Even the Federal Reserve compared stablecoins to failed “wildcat bank notes,” despite general debunking of that comparison.

Treasury says it wishes to ensure that stablecoins are “reliable” during financial panics. Stablecoin issuers could get caught in a bank run that drains their assets.

Read more: [Treasury overlord Yellen worried crypto undermines US sanctions, dollar]

And Treasury’s list of threats facing stablecoins is practically endless, with details surfacing of new theoretical attack vectors on stablecoins at least monthly.

Nevertheless, the use of stablecoins continues to grow dramatically.

According to data from Messari, payments made using stablecoins were valued at $250 billion in 2019, $1 trillion in 2020, and $1.7 trillion by the second quarter of 2021 alone.

Stablecoins could be used for positive applications like streamlining international remittances, decentralizing monopolistic industries, banking the unbanked, and many other positive scenarios.

One can be sure, Treasury Secretary Janet Yellen will repeat endless concerns that cryptocurrencies — and especially stablecoins — could sidestep the US dollar, reduce US GDP, and otherwise compromise US interests.

Follow us on Twitter for more informed crypto news.