Early Bitcoin buyer ‘vindicated’ by ruling on crypto lost to exchange owner

An early Bitcoin buyer is down about $2 million but still feels vindicated after a years-long crypto court battle.

British Columbia (BC) Supreme Court recently settled a dispute between self-styled computer geek Scott Nelson and one-time crypto exchange operator Michael Gokturk.

Nelson sold 50 BTC to Gokturk — founder of Einstein Exchange — in 2019. Bitcoin was worth $8,000 at the time, valuing the deal at $400,000.

Today, 50 BTC would fetch nearly $2.8 million.

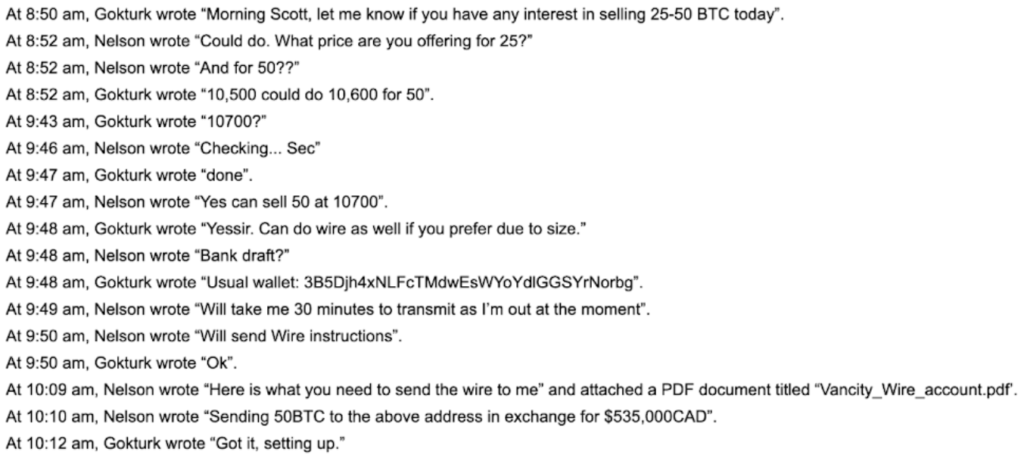

According to court docs, Gokturk agreed to buy the Bitcoin from Nelson at CAD$10,700 ($8,800) each.

- Nelson sent 50 BTC to Gokturk along with wire details to settle the sale.

- Gokturk confirmed receipt of the BTC and told Nelson he was “setting up” payment.

- Nelson never received payment from Gokturk — or his Bitcoin back.

In April, Madam Justice Sheila Tucker ordered Gokturk to pay CAD$535,000 ($440,000) for the 50 BTC he bought in June 2019 — far less than its value today.

Indeed, BC Supreme Court ruled the reimbursement shouldn’t reflect Bitcoin’s quintupled price.

“The fact that Bitcoin is worth more now than it was at the time of the contract does not result in an injustice,” said Tucker.

Nelson, a Bitcoin buyer before it was cool

In an email exchange with Protos, Nelson explained he grew interested in Bitcoin back in 2011, when the cryptocurrency just two years old.

Nelson first bought some Bitcoin then operated a small mining operation until 2014 (before it became too competitive, he noted).

After the market spiked in 2018, Nelson realized he had enough crypto assets to cash out and build a house.

“Gokturk was introduced to me through a mutual acquaintance and he agreed to purchase large sums worth five and six figures,” said Nelson.

“I planned to use the funds to start renovating a dilapidated house I had purchased with my wife.”

According to Nelson, he and Gokturk completed several smaller transactions before Gokturk walked away with the 50 BTC, which represented a substantial portion of his total crypto portfolio.

… then Einstein imploded

By November 2019, the British Columbia Securities Commission (BCSC) had opened an investigation into Einstein Exchange.

Swathes of Einstein Exchange users had lost access to funds stored on the platform. The company was later found owing over $13 million to its customers.

Gokturk filed a number of responses to BC Supreme Court in the months following. He claimed he was not personally liable for Einstein Exchange’s dealings.

However, the court cited a contract in the form of Signal chat logs that named Gokturk directly, not the exchange.

Speaking of the case’s significance, Toronto-based litigator Evan Thomas — who specializes in digital assets and blockchain — told CBC it’s one of only a few crypto disputes in Canadian legal history.

“It’s interesting to see judges treat Bitcoin as property in the same way as a physical asset like a gold bar,” said Thomas.

[Read more: Bitcoin thieves got away with ATM double-spending spree across Canada]

As for Nelson, he’s no longer in crypto. “My house is nearly complete and — thanks to the rise in the markets since 2019 — I’m not as anxious for getting that money as I would have been otherwise.”

“I can tell you that I feel vindicated by the ruling as I feel that I was treated poorly by Gokturk,” he said, before adding the ruling demands Gokturk surrender personal assets to pay what he owes (plus interest and costs).

“I’m pretty sure I will be a better steward of that capital than he will ever be,” said Nelson.