Germany says ‘nein’ to Binance, stock token warning stays

Germany’s finance watchdog has shrugged off crypto exchange Binance’s request to remove a notice that warned its new stock tokens could violate European securities law.

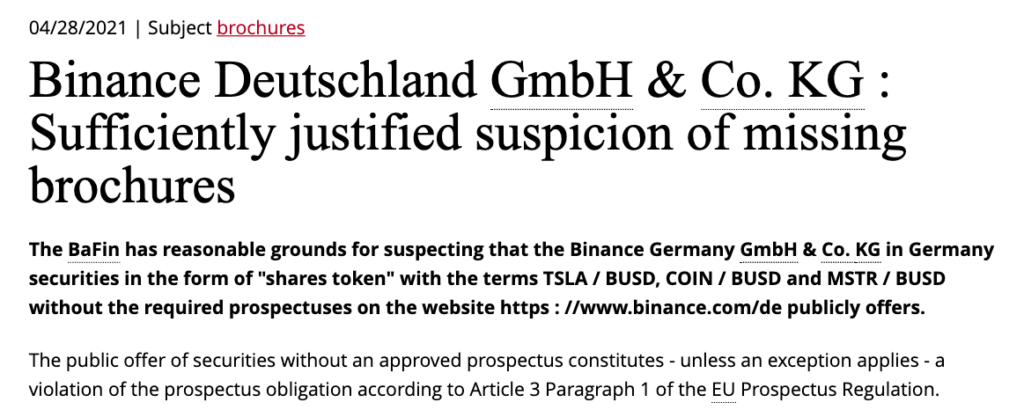

German regulator BaFin signalled the dispute last week. BaFin said Binance may have breached securities rules when it sold tokenized stocks tied to companies like Tesla, Coinbase, and MicroStrategy.

BaFin told the Financial Times (FT) that investment products like securities demand the “minimum information required by law and whether its content is understandable and coherent.”

Nobody can sell securities — tokenized or otherwise — to the German public without a prospectus, which BaFin must approve before they’re offered.

- Breaches of prospectus obligations are punishable under German law.

- BaFin can issue fines up to €5 million ($6 million) or 3% of last annual revenue.

- Binance expected to make $1 billion in profit last year — the max fine is tiny for the exchange.

BaFin also reserves the right to fine issuers up to twice the economic benefit generated as a result of the infringement.

Binance still selling stock tokens to Germans

Binance, the world’s top crypto exchange by volume, initially claimed BaFin based its warning on a “misunderstanding.”

The Cayman Islands-based exchange said its stock tokens don’t fall under securities law. Binance users technically trade them via third-party broker that can do so without a prospectus.

A number of crypto exchanges, including Binance rival FTX, use the same broker for their own stock token products. Traders also can’t transfer Binance stock tokens or send them to other exchanges.

In response, BaFin told FT that Binance simply listing the tokens makes them securities, which requires prospectus.

Binance, on the other hand, said it took compliance obligations very seriously. A spokesperson commented the exchange had committed to addressing any questions regulators may have.

Other nations give warnings

Meanwhile, the UK’s Financial Conduct Authority (FCA) is too examining Binance’s stock tokens for potential breaches of local securities law.

“[Binance] offers a number of regulated and unregulated products and services across multiple jurisdictions,” the FCA told Reuters last week.

“We are working with [Binance] to understand the product, the regulations that may apply to it, and how it is marketed,” said the watchdog.

Hong Kong Securities and Futures Commission (SFC) reportedly marked Binance’s marketing for its Tesla stock token a regulated activity.

Those require licenses in Hong Kong, and Binance does not have any such license in the city, SFC noted.

And though Binance has restricted US traders from its stock tokens, SEC commissioner Hester Peirce warned they would still “be an issue of concern for the SEC as it relates to our securities markets.”