China wants a yuan stablecoin, but why?

According to The Financial Times, China is eyeing a yuan (aka renminbi) stablecoin for both internal and external use, but as even The Financial Times article makes clear, no one knows how it would work or why the Chinese Communist Party (CCP) is so keen to create one.

While the piece does make clear that the CCP is “arguing that the success of dollar-backed tokens is cementing the US currency’s dominance in the global economy,” it fails to identify how a tightly controlled renminbi stablecoin could either exist or impede the continuing US dollar global hegemony over the financial system.

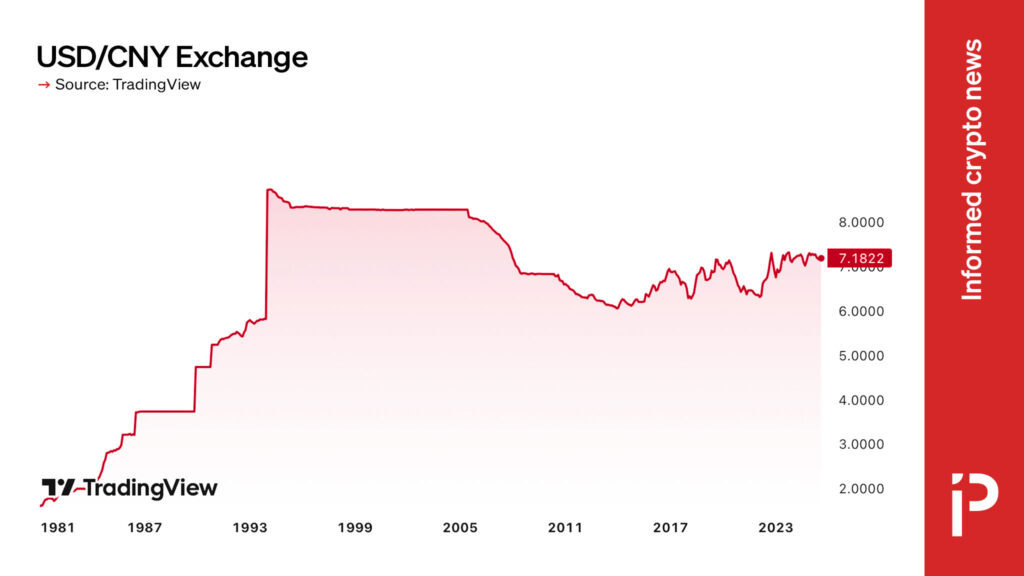

Without getting into the lack of Chinese central bank independence or how the yuan has been structured to keep Chinese exports cheap, the yuan is a weird currency. This is to say that there actually exist two yuans: one for domestic use and one for offshore markets, and they trade at slightly different values (as of writing, CNY, or domestic yuan, trades at 7.189 per US dollar, while the CHN, or offshore markets yuan, trades at 7.193 per US dollar).

Additionally, know your customer and anti-money laundering laws have substantial penalties in China, and the renminbi can be used far more effectively to sanction individuals, companies, or countries than the US dollar because almost everyone strictly uses the yuan digitally, and the People’s Bank of China can exert full control over any aspect of the currency.

While this enables the CCP to ensure a semblance of price controls, it also has led to many Chinese nationals hunting for ways to exit the currency for more useful international currencies like the US dollar and euro, leading to a significant amount of capital flight. China also has not seen any widespread use of the yuan outside of Mainland China, even with war-torn allies like Russia and Iran.

There’s already a Yuan stablecoin

For those familiar with Tether, the largest cryptocurrency company in the world and the stablecoin with the highest market capitalization and most volume, they may also be aware that in 2019 Tether issued an offshore yuan stablecoin.

Since then, the Chinese national who helped them create the stablecoin and find some initial demand, Zhao Dong—known as the OTC king in China once upon a time—has been arrested and sentenced to years in prison. Almost no more Tether yuan has been minted since the arrest.

This suggests that not only are there inherent issues with the ability for Chinese nationals and foreigners to utilize Chinese stablecoins, but it also proves there’s a strong lack of demand for yuan-denominated stablecoins to begin with.

Less control or no demand

China faces a narrowing bridge that it will have to cross while it continues to use Hong Kong as a testbed for all of its stablecoin and cryptocurrency ventures: will it loosen price and capital controls on its currency so that anyone—from businessmen to travelers to criminals—finds the yuan more useful, or will they see their far-reaching dreams of a unified BRICS currency taking down the dollar evaporate into thin air?

It appears as though a renminbi stablecoin could be the first test in years for the People’s Bank of China to either make the yuan a global powerhouse vying with the US dollar in international markets or yet another example of the CCP keeping strong price controls in place to ensure domestic complacency.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.